The tariff war unleashed by U.S. President Donald Trump and its global implications have forced the Reserve Bank of India’s monitory policy body to cut growth rate by 20 basis points (100 basis point is 1%) for FY25, as resultant economic uncertainties underpinned the decision.

“The growth projection for the current year has been marked down by 20 basis points relative to our earlier assessment of 6.7% in the February policy. This downward revision essentially reflects the impact of global trade and policy uncertainties,” RBI Governor Sanjay Malhotra said in his monetary policy statement on Wednesday.

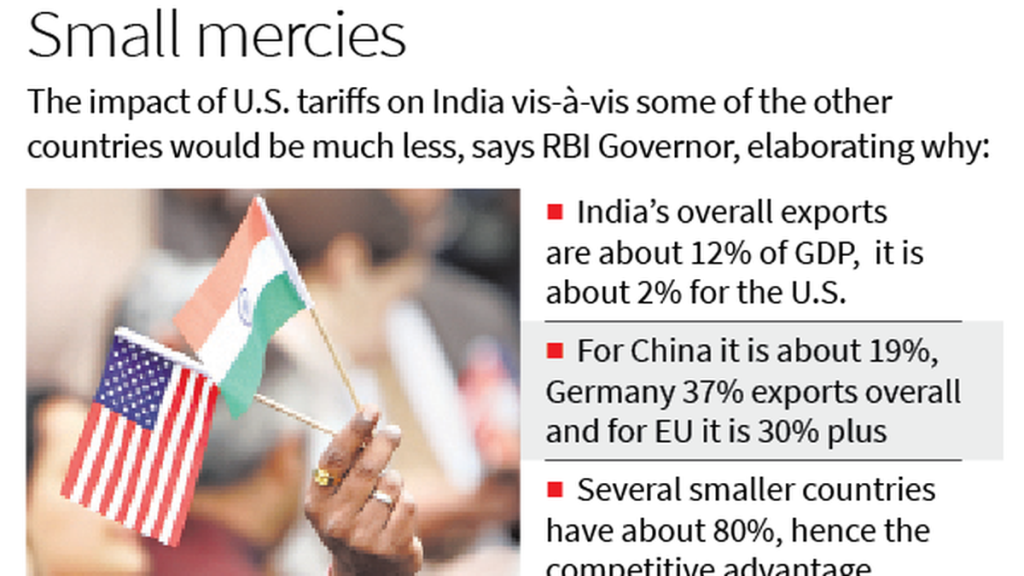

But considering India’s low volume exports to the U.S. and comparatively less trade surplus, the adverse impact on India would be far less in intensity compared with most countries, he said at a press meet post the MPC meeting.

“The impact would be different for other countries depending on the situation that they are in. For India, we have given our assessment as you can see, the growth rate we have reduced by 20 basis points this year, primarily arising out of the uncertainties,” Mr. Malhotra said replying to The Hindu.

“And on the inflation front, we have said it can move actually both ways because of the demand that is going to shrink as a result of the trade tariff friction. It may help the inflation front. So all in all, more than inflation, we are concerned about its impact on growth,” he said.

Mr. Malhotra said the impact of these tariffs on India compared with other countries would be much less. “Our overall exports are about 12% of GDP, and it is about 2% for USA. You compare it with some other countries… even for China it is about 19%, Germany 37% exports overall and even EU is 30% plus. And several smaller countries have about 80% (of their GDP is exports). So to that extent we are in a better place than some of the other countries.” he highlighted.

“And so we have, in some ways a competitive advantage vis-à-vis some of these countries insofar as the USA is concerned.”

About the likely impact of China’s possible move to devalue its own currency, on the Indian rupee, he said the rupee would find its own level and in case of excessive volatility, the RBI would intervene.

“Our currency is quite stable. We have sufficient reserves, almost $700 billion, and our deficits are also again very sustainable for this year and next year. I really don’t think, we are under any kind of a stress or stressful position,” he emphasised.

Published – April 09, 2025 10:27 pm IST